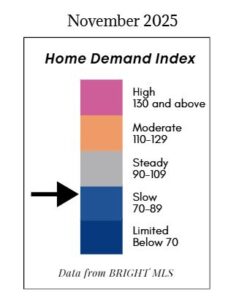

The Home Demand Index (HDI) for the Washington D.C. metro area is at 87 during this report period, down from 95 in the previous month. This decline reflects a slowdown in buyer activity. Compared with last year’s index of 72, demand remains significantly stronger on an annual basis, reflecting a notable improvement over the same period.

The market category has shifted from Steady to Slow, highlighting a deceleration in overall activity.

Buyer demand across home types in Washington D.C. shows a downward trend, with all segments experiencing lower activity. Entry-level single-family homes recorded an index of 80, down from 84 in the previous month but up from 68 a year ago, indicating slower activity yet strong year-over-year growth in affordable segments.

Mid-range single-family homes also declined, with the index falling to 81 from 88 in the previous month, suggesting cooling among move-up buyers. Luxury single-family homes dropped 19% compared with the previous month but remain 17% above last year, while luxury condos fell 20% in the previous month yet are still 13% higher than a year ago. This pattern reflects a general slowdown in the market, though demand remains stronger than the same period last year, likely influenced by inventory availability and evolving buyer preferences across price tiers.

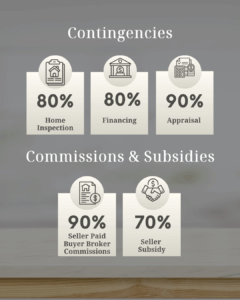

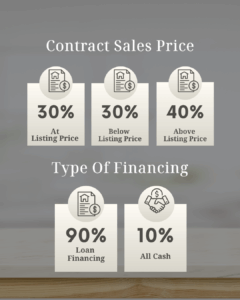

Here’s a snapshot of what local title companies in Loudoun County are seeing in the most recent contracts. It’s a great indicator of what terms are being accepted in today’s market. Most buyers are now able to include a home inspection and retain their appraisal contingency.

If you are considering a move in 2026, now is the time to get guidance and support on how to navigate the housing market. Message me to get started.